-

Membership

Membership

Anyone with an interest in the history of the built environment is welcome to join the Society of Architectural Historians -

Conferences

Conferences

SAH Annual International Conferences bring members together for scholarly exchange and networking -

Publications

Publications

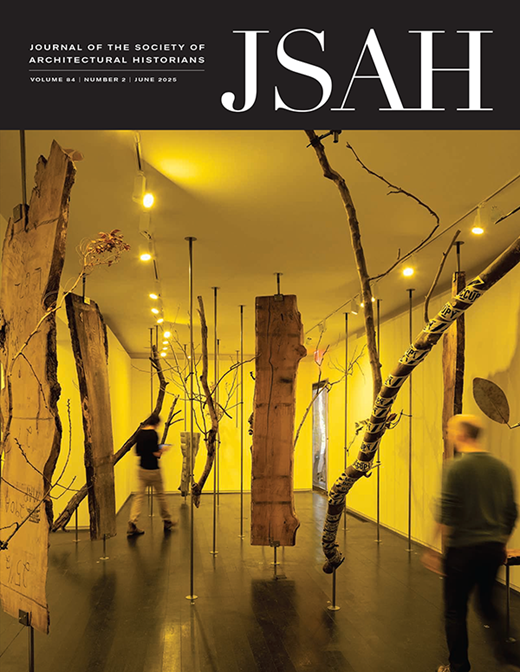

Through print and digital publications, SAH documents the history of the built environment and disseminates scholarshipLatest Issue:

-

Programs

Programs

SAH promotes meaningful engagement with the history of the built environment through its programsMember Programs

-

Jobs & Opportunities

Jobs & Opportunities

SAH provides resources, fellowships, and grants to help further your career and professional life -

Support

Support

We invite you to support the educational mission of SAH by making a gift, becoming a member, or volunteering -

About

About

SAH promotes the study, interpretation, and conservation of the built environment worldwide for the benefit of all

SAH Annual Fund

Individual giving makes up a significant portion of SAH's annual budget. With your support, we are building a vibrant Society dedicated to academic integrity, inclusivity, advocacy for architectural history and preservation, and support for one another as a scholarly community.

Each year, through the generosity of our members and friends, SAH awards more than $130,000 in fellowships and grants to dozens of scholars and enables 50 or more members to attend the annual conference. View our latest annual report to see the impacts of past gifts and discover where your donation will make a difference.

SAH is a 501(c)(3) nonprofit organization. Contributions are tax-deductible according to IRS laws.

SAH's tax identification number (EIN) is 20-2507723.

Ways to Give

There are several ways to help support the Society of Architectural Historians. SAH is a 501(c)(3) nonprofit organization. Contributions are tax-deductible in the U.S. according to IRS laws.

Outright gifts of cash are fully tax-deductible. Gifts may be made online (Visa, Mastercard, American Express, Discover, bank transfer) or by check made payable to SAH and mailed to 1365 N Astor St, Chicago, IL, 60610. Unrestricted contributions to the SAH Annual Fund are preferred as this allows us to apply those funds to the areas of greatest need. SAH accepts donations from Donor Advised Funds.

If your stock is held in a brokerage account, your broker can transfer your gift to us electronically. Contact Beth Eifrig at beifrig@sah.org to receive instructions for transferring your gift of securities and to provide donor information and stock transfer details.

Individuals aged 70.5 years and older can make a direct transfer of funds from their IRA to a qualified charitable organization such as SAH. Contact your tax advisor for details and please let SAH know when a disbursement has been made from your account.

Many employers will match charitable contributions to SAH with an equal or higher amount to that of their employee, board member, retiree, or employee’s spouse. If your employer offers such a program, please consider SAH for the matching gift.

Create your long-term legacy and help ensure the future of the Society of Architectural Historians through a deferred gift. Planned gifts or estate plans may include a bequest to SAH in your will, your IRA, making SAH a beneficiary of a life insurance policy, transferring real estate or stocks, or other deferred contributions. For more information on planned giving, or to discuss the aspirations for your legacy, please contact Executive Director Ben Thomas at bthomas@sah.org.

Society of Architectural Historians

1365 N. Astor Street

Chicago, IL 60611

Tax ID: 20-2507723

Society of Architectural Historians

1365 N. Astor Street

Chicago, IL 60611

Tax ID: 20-2507723

Donor Recognition

SAH thanks its donors for their support of our mission and educational programs.